Save Money Tips

Change one habit and save

Small changes can make a big difference to your bank balance. Change one thing you do regularly and you could save money. Some examples are:

- Give up drinking coffee or cut down on alcohol – it may sound scary but it will save you money and can have health benefits.

- Cancel your gym membership and walk to work instead.

- Make your lunch at home.

- Have people over for dinner rather than going out and ask everyone to bring a plate of food.

- Borrow books and DVDs from the library.

- Lock up your credit card for a month and only pay for things with cash.

- Get into the habit of checking your bank statements.

- Set a limit for birthday and Christmas presents or give homemade gifts.

- Share gardening tools and equipment with your neighbours rather than each buying one of

QUIT SMOKING

For a lot of smokers, money is a huge motivator for giving up, and with good reason. The financial benefits that come with quitting smoking can be surprisingly substantial. Just think about how much you spend every day, every week, or even every year on your habit. If you spend $13 on each pack of 20 cigarettes, for example, and you’re a 20 a day smoker, that is $390 a month. That’s around $4.680 every year!

Cost of smoking

With government plans to increase the tax on cigarettes in the coming years, there’s now even more financial incentive to quit. It’s up to you how you manage your savings – you might want to enjoy your extra funds in the short term. Alternatively, you might be a little more careful and save most of it for a rainy day. However you decide to enjoy it, the first task is to turn the theory into a reality and start saving! You’re going to be amazed at what you can throw your extra cash at when you’re no longer buying cigarettes.

As a non-smoker, you’ll be saving serious money by not smoking anymore. There will be all kinds of financial possibilities at your fingertips in place of that cigarette that used to be there.

Think about all the cash you’ve been spending on cigarettes every day. Over a week, or a year, all that cash will really pile up. Over your lifetime, you could be looking at tens of thousands of dollars, and now you’re free to use it for something far more interesting and exhilarating. So if you’ve just quit or are about to, start feeling excited about what you’re going to do with all your extra spending money!

Switch off and unplug appliances

A quick and easy way to reduce your electricity bill is to turn off appliances at the powerpoint when you’re not using them. When things like computers and TVs switch into standby mode, they still use electricity, which can really add up over time.

Get into the habit of turning off and unplugging your kettle, stereo and other items when you’re not using them.

Other ways to switch off and save are:

- Unplug your second fridge – If you have a second fridge, keep it unplugged and switched off until you need it.

- Dress for the temperature – Put on a jumper and warm socks instead of turning on the heater.

- Avoid using the dryer – Hang your washing outside on sunny days, and use an indoor clothes rack when it’s raining, instead of using the clothes dryer.

- Hot water bottle – Use a hot water bottle instead of an electric blanket. If you do use an electric blanket, turn it on to warm up the bed before you get in. Then, turn if off before you go to sleep.

Amazon Subscribe and Save

How does it work?

Set up regularly scheduled deliveries and earn savings with Subscribe & Save. Unlock extra savings on eligible subscriptions when you subscribe to five or more products at one address on your monthly delivery day. From diapers to toothpaste to dog treats, you can subscribe to thousands of everyday products.

How do I start a subscription?

Select “Subscribe and Save” on the detail page for thousands of eligible products in the Subscribe & Save store.

Select the quantity and schedule that works for you, from monthly to every six months.

Skip your deliveries or cancel your subscriptions at any time by visiting Manage Your Subscriptions

In advance of each delivery, we will send you a reminder email showing the item price and any applicable discount for your upcoming delivery. The price of the item may decrease or increase from delivery to delivery, depending on the Amazon.com price of the item at the time we process your order.

How do I save up to 15% on my auto-deliveries?

Save up to 15% off when receiving 5 or more products in a given month to a single address.

Prime members unlock 20% savings on diapers and baby food subscriptions when receiving any 5 or more products in a given month to a single address, compliments of Amazon Family.

The 10 seconds rule

Whenever you pick up an item and add it to your cart or to take it to the checkout, stop for 10 seconds and ask yourself why you’re buying it and whether you actually need it or not. If you can’t find a good answer, put the item back. This keeps me from making impulse buys on a regular basis.

Try to fix things yourself.

Years ago, it was far more difficult to find ways to fix everyday items we have in our homes. But today, it should be a piece of cake. You can find online tutorials and videos that show you how to fix almost anything, and all for free. No matter what you’re trying to fix, it’s always worth a shot. Learning a new skill never hurts either.

Take public transportation.

If the city’s transit system is available near you, take it to work instead of driving your car. It’s far cheaper and you won’t have to worry about the added expense or hassle of parking your vehicle either.

When you lived in a larger city, you buy an annual transit pass that actually pays for itself after less than two months of use compared to using an automobile. After that, for 10 months, you basically could ride to work (and to some events) for free. That’s money in the bank

Pack food for road trips.

Whenever you’re ready to hit the road, take some time to pack snacks and meals you can easily eat on the go. That way, instead of stopping in the middle of the trip, driving around looking for a place to eat, spending a bunch of time there, and then paying a hefty bill, you can just eat on the road or, better yet, stop at a nice park and stretch for a bit. Convenience foods are notoriously expensive, so you’re better off avoiding them whenever possible

Use the 30-day rule

What about more expensive items? For more expensive items – and you can draw the line between “cheap” and “expensive” where you please – simply choose to wait 30 days after your first serious impulse before buying the expensive item, provided that it’s not an essential or emergency need. Use that time to do a little research and make sure you actually want or will use the item, and also give it time to just sit there and see if the desire dies down. You’ll find that, more often than not, you won’t want the item after thirty days

Dropping your phone

Dropping your phone and cracking the screen can completely ruin your day. While most handsets aren’t built to be repaired, with the right tools and a little know-how, you can fix many problems with your handset for cheaper than an insurance claim. you can find a lot online on how to change your screen

While it should go without saying, opening up your phone will almost certainly void your warranty and, if you have insurance on your device, you will likely be unable to successfully make a claim if you choose to self-repair. If you’re comfortable enough with a tiny screwdriver and electronic components, have at it. However, if you’re unsure or don’t want to risk it, talk to your carrier or manufacturer before you try to break open that phone.

Get your hair done for free.

Search online for local beauty schools. An appointment with a student in training may mean a majorly discounted (or even free) haircut.

Sign up for rewards cards.

If you’re looking for an easy and painless way to save money on everyday expenses, look to your credit card for hep. That’s right with the right rewards card, you can save money on everything from your regular bills to your household expenses.To get these savings, you’ll need a rewards card that offers a percentage of cash back for every dollar you spend.

Buying in bulk

Buying in bulk can save a family up to $500 per year. It may also mean spending less time in the supermarket, which can result in even more savings, as most of us frequently indulge in spontaneous purchases. If you’re not there, you won’t succumb to these little purchases that can quickly add up! Finally, shopping strategically means visiting the store less and maybe driving less — saving gas and even more money.

Switch to a Low-Flow Shower Head

Low-flow showerheads use 2.5 gallons per minute (gpm); older models use as much as 5.5 gpm. Make the switch and you’ll reduce your water bill by 25-60%

shorter shower with a low-flow showerhead, you’ll use 12.5 gallons of water or less. Compare that to 37.5 gallons for a 15-minute shower, and the savings is pretty easy to see.

Turn the Water Off While You Brush/ Shave, Less flow time equals less water used.

Add Attic Insulation

According to the U.S. Department of Energy (USDE), the attic is where most of your home’s heat escapes to. Why? Well, heat rises, and most homes don’t have enough insulation up there to keep it from getting out. So, out it floats.

Fiberglass insulation is relatively cheap, and it’s easy to install it yourself. Energy Star estimates you can save up to 20% on your heating and cooling costs by effectively insulating your home. Here you can definitely save at least 10% on your utility bills every year. And adding the insulation was very easy to do.

If you’re worried about installing attic insulation yourself, do a quick search online. There are tons of DIY tutorials that will coach you through the process.

Save on your phone, cable and intrenet

For most families, these three services equal big bucks every month. Monitor your use over a month or two, and decide what you actually need and what you could cut. Do you really watch any premium channels? Is the landline doing anything other than collecting dust? How fast do you need the internet to be if you’re only checking Facebook and email? It truly pays to shop around and find a cheaper cell phone service.

Line dry your clothes

Your clothes dryer is a utility hog. It takes a great deal of electricity to heat up your clothes to dry them. it costs about $16.98 per month to run your dryer, which makes it the most expensive appliance to run in your house even more expensive than your refrigerator. In addition to that, clothes that dry on a clothes line tend to last longer than those that go through a dryer, so line drying will also reduce your clothing expenses.

Make yout own coffee

Let’s start with the bare facts: yes, you will obviously save money by making your coffee at home rather than buying it on the way to work. You always save money by making things at home — be it coffee, sandwiches, pants, babies, whatever. Depending on where you live and how you prefer to take your hot caffeine water, if you’re buying coffee, you’re spending between $1 and $5 per cup. Meanwhile, brewing a cup of coffee at home costs you between 20 and 25 cents per cup.

Make your own lunch

Buying lunch can run anywhere from $4 for, say, a cup of soup and a roll, to $15 (or more) for a restaurant lunch or some take-out sushi. Let’s just call the average daily lunch about $10, which gets you a fancy sandwich with some chips and a soda.

Make that same fancy sandwich at home, and you’re spending remarkably less. Using the ingredients you buy at a grocery store, a sandwich that a deli charges $6 for would probably cost you less than $2 to make at home. Add in a buck for a bag of chips and a buck for a drink, and we’re at $4, less than half the cost of typical weekday lunch out.

At $4 for lunch, that’s a 60 percent savings over eating out. If you save $6 a day, five days a week, that’s $30 a week, $120 a month, and almost $1,500 a year.

Make your own candle

A high-quality 6oz candle can run you $20-$30, and even more if it has a luxury brand name attached to it. So a little investigation on what it would take to make your own, and if you could replicate those high-quality products for a fraction of the cost.

Turns out homemade candles cost just a few bucks each, smell and burn just as well as the expensive ones, and make for a fairly easy project that won’t take you more than a couple hours. They make for great additions to your workspace or den, as well as excellent and inexpensive DIY gifts for your loved ones.

Use coupons whenever you can.

The art of grocery shopping using coupons. One tip that helps save money is previewing coupon sites and combining sales with weekly coupons to find the best weekly deals. This can help to cut the grocery bills in half when you shop!

Reverse Season Shopping.

Always buy winter clothes in the summer and summer clothes in the winter. This reverse season shopping can save you so much money because winter clothes are always on sale in the summer and vice versa. Reverse Season shopping for clothes can really save you from spending a lot of money on clothes that can be bought at a cheaper price.

Use a programmable thermostat

Programmable thermostats save you an estimated 10-20% on your heating and cooling bills. When you aren’t home, or are sleeping, our house is quite a bit warmer or cooler, depending on the season. You can save a substantial amount on our utilities compared to many of our neighbors!

Install CFLs to save energy.

Compact fluorescent lights use about a quarter of the electricity of normal incandescent bulbs. They also need replaced much less often – often lasting five years or longer. LED lighting has become popular recently and the bulbs use even less energy than CFLs. However, the bulbs are still very expensive

Bottle your own water

There’s something satisfying about bottled water, but that doesn’t mean you have to buy a new bottle every day. Buy the bottle and then subsequently refill it from a tap or water cooler

Add an Irrigation Meter

You probably pay sewer fees based on the amount of water you use, even if half of it winds up on the lawn instead of in a wastewater treatment plant. Ask your utility to install a separate meter for landscaping water (you’ll bear the cost) and you’ll pay sewer fees only for water used indoors.

That could save you about 50-70 dollars a year

Stop Drafts Around Drapes

You can save up to 10 percent on your heating bill just by closing the curtains at night. Up that number by nipping drafts around the edges: Install a cornice or hang drapery panels at the ceiling, letting them fall to the windowsill or floor. Seal outer edges to the wall and inside edges to each other with Velcro tape Or add insulated liners and treat them the same way

Join Store Loyalty Programs

Supermarkets, pharmacies, and retailers all offer loyalty cards these days. The points and savings really add up. You can save almost 25% or more off purchases just by being part of the program.

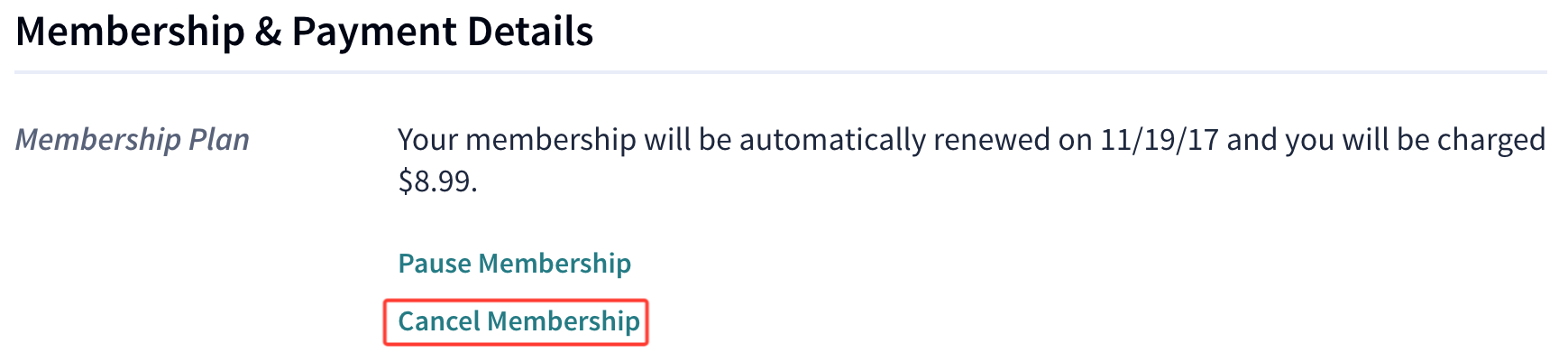

Cancel Certain Memberships

Got a credit card with an annual fee, a rarely used gym membership, or a club you pay for but don’t access? Time to cut it out and get rid of the extra cost that’s not worth the reward.

Start Using Rechargeable Batteries

If you burn through batteries frequently, then it’s time to make the switch to rechargeable. You’ll end up saving in the long run by ditching the disposables.

Shop on Wednesdays

According to Yahoo! Finance, “Financially, the best day of the week to go shopping is likely Wednesday – that’s the day grocery stores start their weekly discount and coupon programs. It’s also a day most stores will honor coupons from the previous week, giving shoppers a ‘discount double play’.”

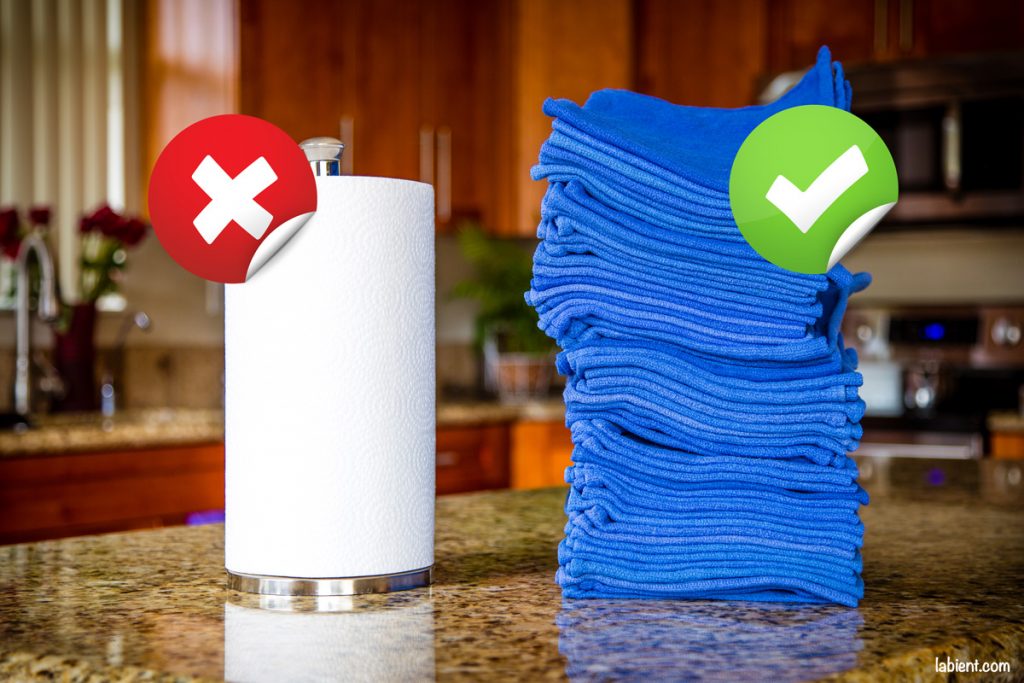

Paper Towels and Napkins

Really? Yes really! Paper towels and napkins are expensive, and if you’re worried about waste, you should seriously consider eliminating these from your household. Use rags, towels, and things like Unpaper Towels that are reusable and washable. These can go around your normal paper towel holder.

Automate

Research reveals that we get used to living on a certain budget if that is all we have. But if more money shows up in our checking account (from our paycheck, for example), we tend to spend it. So setting up an automated monthly withdrawal from your checking account to your investment account, or to pay down debt, is an effective way to save more. Think of that monthly withdrawal as an obligation you can’t turn off, and you’ll quickly learn to live within the new budget.

Bag Sales

Shoppers can cram whatever merchandise they can fit into a shopping bag to receive a percentage discount at checkout (some restrictions may apply). In the past, ACE Hardware has been known for its BYOB “Bring Your Own Bag” Sale usually held in February, and Staples and Menards are among other national retailers that have hosted bag-type sales. Bonus Tip: Many local thrift stores also run bag sales sometimes as frequently as one day every week or month when often all of the clothing you can fit in a shopping bag is yours for one flat price.

Back-to-School Sales

These aren’t only for families with school-age kids anymore and go way beyond pencils and paper. The sales, which now start as early as July, offer deals on computers and phones, fall apparel, summer sports equipment and, of course, traditional school and office supplies. National retailers including Wal-Mart, Office Depot/Office Max and Walgreens usually get in on the back-to-school sale action. Check to see if your state offers shopping dates without sales tax during this time to compound your savings.