Personal Finance tips

Make a budget

It is helpful to look at the money going in and out across a whole year. Include regular payments such as your rent or home loan, phone and electricity, car or public transport.

Checking your bank statements, bills, credit card statements, receipts and shopping dockets will help you to work out all your expenses. Use your best guess if there’s anything you can’t find or if bill amounts vary across the year. Get our top tips on checking your bank statement.

Add in all the money that you receive or are paid over the time period. This could include your pay from your full-time or part-time job, any casual work, your pension, government benefits, child support payments and any money from investments. If your income is variable, make an estimate based on your past year’s earnings.

When working out your money priorities, think about which items you need for your basic living expenses and which are extras or things you could maybe do without if you needed to save some money.

Taking surveys

Taking surveys

Taking surveys is a super easy way to make money. The amount of money you can earn taking surveys varies greatly. You will earn around $0.50 – $5.00 per survey when you do this.

If you want to give this a try I want you to keep a couple things in mind. First and foremost, taking surveys can be frustrating. If there is a “pre-qualifier” to a survey (meaning you take a survey to see if you qualify ) then you’re going to spend a pretty decent amount of time to earn a paltry amount. Second, taking surveys is meant as supplementary income and you definitely shouldn’t expect to replace your day job with it.

Since you’ll likely only get a few surveys each month from each site it’s good to sign up with several different survey panels if you want to earn some spending money.

Garage sale

The first step is to choose dates and times for your garage sale. Most people go with Saturday mornings, but you can add Sunday to a multi-day sale if your schedule allows.

You’ll get a larger crowd if you start early because people won’t have to interrupt their day to attend your sale, and it’s likely to be cooler out which is an important consideration especially in the heat of summer.

Garage sales offer a great way to declutter and downsize your house. Grab a box and go through every room. Pick up anything you don’t want or haven’t used in months and toss it in. Don’t forget closets, attics, basements, and garages as these are usually treasure troves for garage sale finds. Don’t underestimate the value of what you find either; people will buy anything from old CDs to unwanted bottles of perfume. After all, the worst case scenario is that something doesn’t sell.

Many cities now require that you have a permit to run a garage sale. Check with a clerk at your city or town hall to find out if you need one. Don’t try to run a garage sale without it or you may end up getting shut down and fined.

Do not play the lottery

The lottery is a for-profit enterprise, meaning that the lottery keeps more money than they pay out. That means you’re extremely likely to wind up on the losing end of the stick, paying in more money than you’ll ever get out of the lottery. Don’t do it – it’s a true waste of money. The same thing is true for casino games of chance.

Switch to cash

Using cash may not always seem very convenient, but it is a great way to stop yourself from overspending. It causes you to think about your purchases, and consciously consider how much you are spending. This can really help you to stop using your credit cards as well. Go to the ATM and withdraw the amount you need for a week and stick to it. The money you have left after the week, you put in a saving jar. If you need to make online purchases then use your card, and only then.

Pay off your cards

The first thing you should prioritize is paying off the monthly minimum on each of your credit cards. If you don’t pay your minimum, you’ll start getting hit with late fees which can add up fast. And if you fall far enough behind, your credit will suffer.

Your credit score is based on your performance in five categories: Amounts owed, new credit, length of credit history, credit mix and payment history. The latter, which can be hit by missing minimum payments, accounts for 35% of your overall score. If you have money left one month and want to pay extra, choose one card and start paying off that and only that

Short-term saving

Short-term goals are things you want to achieve within the next couple of years. These goals could be to pay off your credit card debt, buy a new TV, go on a holiday or buy a car. Whatever you have in mind, set yourself a realistic timeframe.

The best way to save for short-term goals is to reduce your spending on non-essential items, like entertainment, dining out, memberships or subscriptions. It is often easier to stay on top of your spending if you use cash, when shopping instead of using your credit card.

Make your savings work for you by putting your money into an account where it will grow. Savings accounts are great because you can earn compound interest on your savings.

Reducing your credit limit

If you want to avoid the temptation to overspend on your card, ask your credit provider to reduce your credit limit. You can do this by phone or by visiting a branch. In most cases, your account will be updated within 1-2 business days.

If you need to increase the limit to make a special purchase, aim to pay the debt down quickly, then lower your limit back to a more manageable amount.

planning to invest

If you’re planning to invest, being well prepared will improve your chances of success. Think about your investment goals and where you want to be in the future.

Ideally you will have at least one financial goal in mind, however smart investors think about short, medium and long-term goals. Allocate a timeframe to achieve each goal. To find out more read our tips on financial goal setting.

Once you have set your goals you’ll need to develop an investment plan that meets your needs and is achievable.

Get to know the investment

Before you jump into any investment, you’ll want to know:

How is my money being invested?

How well has the investment performed compared to similar investments over the last 5-10 years?

What are the fees (including up-front and ongoing fees, performance-based fees and exit fees)?

Is there is a ready market if I need to exit the investment?

Read the product disclosure statement (PDS) for each investment product and make sure you understand the product’s key features, fees, commissions, benefits and risks. Ask the product provider or a financial adviser if you need further clarification.

Switch bank accounts

If you are being charged feed on your checking account or getting almost zero interest from your savings then it may be time to switch banks.

You can get more than 10 times the interest using a high interest online savings account and there are plenty of free online checking accounts with no deposit. With either of these options you will save money over the bricks and mortar options.

Recycle your cans and pop tops

Aluminum from recycled cans, including the pull tabs, is the same as the one that is smelted from virgin ore. Simply put, the can itself is equally as valuable as the pull tab. Note also that the whole can by far outweighs the pull tab. A pound of aluminum equals approximately 1000 pull tabs or 34 empty cans. Just step on the cans and put them in a bag then it take less space, same with the pop tops, save them in a zip lock bag.

Old phones and laptops

A number of online tech vendors will accept old phones and laptops in exchange for cash, just make sure to clear your device’s history first. If you’ve got an Apple product and it’s in good shape, you may quality for their Recycling Program, where you’ll trade the device for a gift card to put toward a new one.

Thrift Store Treasure

Thrift stores are full of things you can sell to make money. There are tons of people that resell as a full-time job!

It can be done. It does take some work, research, and time, but if you want it to pay like a job, then you need to treat it as a job and dive in! Designer Clothing is the hidden treasure of thrift stores! I have personally found dozens and dozens of designer pieces of clothing at thrift stores Brand New! Tags still on them!

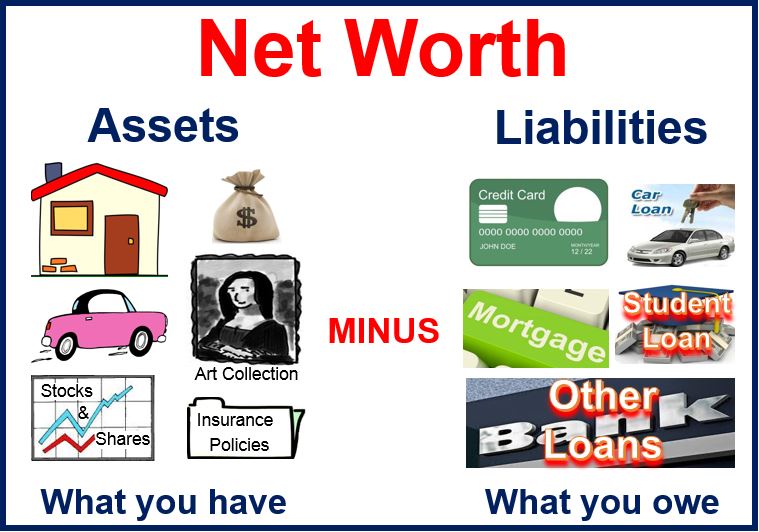

Track Your Net Worth

Your net worth the difference between your assets and debt is the big-picture number that can tell you where you stand financially . Keep an eye on it, and it can help keep you apprised of the progress you’re making toward your financial goals or warn you if you’re backsliding.

Set Specific Financial Goals

Use numbers and dates, not just words, to describe what you want to accomplish with your money. How much debt do you want to pay off and when? How much do you want saved, and by what date?

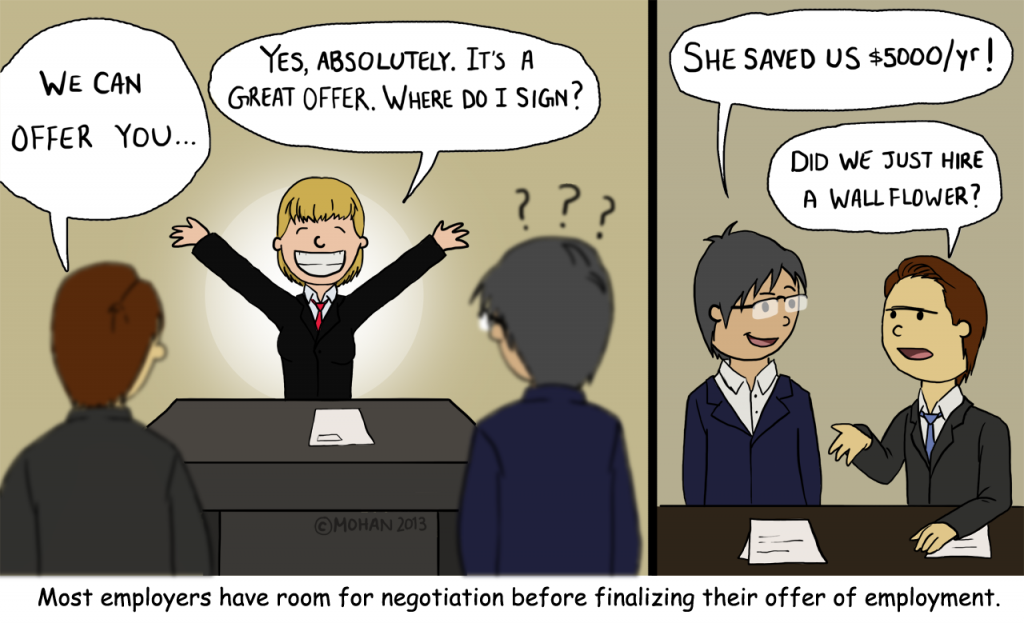

Get the Company to Name Figures First

When Negotiating a Salary, If you give away your current pay from the get-go, you have no way to know if you’re lowballing or highballing. Getting a potential employer to name the figure first means you can then push them higher.

Start Saving ASAP

Not next week. Not when you get a raise. Not next year. Today. Because money you put in your retirement fund now will have more time to grow through the power of compound growth.

Treat pay rises as an excuse to save, not to spend

It’s easy to allow your expenses and spending to expand to fit your new salary. Instead, try to live on your old budget. You can use the difference to pay off debts, or boost pension payments.

See saving as a gift to your future self

Refer to saving as something positive, such as a financial freedom plan, rather than a budget, which sounds restrictive and boring. It can be difficult to think of yourself as a pensioner when you are still in your 20s or 30s, but visualising your dream retirement or holiday can help make the savings goal seem real.

Establish an emergency fund.

Most experts advise stocking your emergency fund with enough money to cover six months of living expenses. Hitting this mark is a good idea, especially if you’re single, have a less stable career or work in an industry with fewer job prospects.

Create a family spending limit on gifts.

Discuss placing spending limits on gifts within your family and/or a system where you only purchase one gift for one person over the holidays. These limits tend to reduce expenditures and be greatly appreciated by family members with less financial flexibility.